|

|

Proposed Capital Gains Tax Increase:Should Business Owners speed up planned sales?By Mono Bhattacharya, Neil Ursic & Eric Hornung |

|

In his speech to Congress on April 28, 2021, President Biden unveiled the American Families Plan via a bill which includes, amongst other items, proposed changes to capital gains based on income levels.

It is unclear whether or not this bill will pass in its current form or any form. Given the early indications, we are exploring the potential implications of certain aspects of the bill that are critical to business owners. As part of a larger analysis of the current economic situation and market, this piece analyzes the potential capital gains changes.

At RKCA, our job is to support business owners in realizing their life’s work. Tax law changes play a role in the magnitude of that realization.

What Are Capital Gains? The Biden administration has begun to shift its focus away from the pandemic. The administration has started to focus on non-pandemic related policies, including proposals that directly and indirectly impact business owners. One such policy is an increase in the tax rate for capital gains. This proposal has caused uncertainty and concern amongst business owners in the market.

A capital gain is the profit from the sale of a capital asset. To keep things simple, the price at which an asset is purchased is the asset’s “basis.” Selling property, stock, or any asset - like a business - above its basis would be considered a capital gain. In most cases, the seller is then taxed on the profit, the difference between the sales price and the basis.

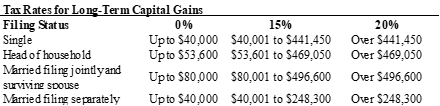

There are two categorizations of capital gains: short-term and long-term. Short-term capital gains are derived from capital assets owned for less than one year. These short-term capital gains are currently taxed at the same rate as an individual’s personal income tax rate. Personal income tax rates currently range from 10 - 37%. Long-term capital gains are derived from capital assets owned for over one year. These have been historically taxed, depending on an individual’s personal income, at a rate from 0 - 20%. |

|

|

Proposed Changes to Capital Gains President Biden’s proposed changes to Capital Gains and tangential tax proposals include:

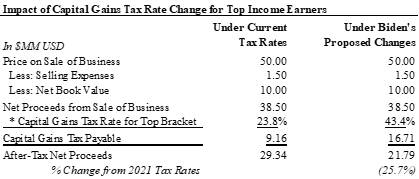

Under the American Family Plan, “[h]ouseholds making over $1 million … will pay the same 39.6 percent rate on all of their income.” Said another way, long-term capital gains over $1 million will be taxed at 39.6%, versus a historical rate of 20%. Moreover, expanding the net investment income (NII) to all households making over $400,000, effectively increases total top tax rates to 43.4%.

It is unlikely – historically speaking – that these proposed changes would be retroactively effective for 2021 (although there were reports in the media last week that the changes may be retroactive as of April 2021). Should this bill, or one like it, be signed into law, our outlook is that it would likely take effect in 2022 or beyond.

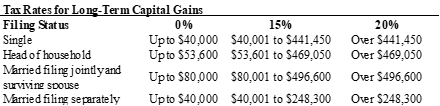

Impact on Proceeds from a Business Sale Ultimately, if President Biden’s tax plan is enacted, there will be a substantial increase in the capital gains tax rate for top income earners. Business owners looking to sell their business often fall into this top income earner category. However, there is a possibility that the proposed capital gains tax rate will remain the same for income earners below $1,000,000. In the end, Biden’s tax plan is still just a proposal. As new plans and policies emerge, these tax proposals could alter in the future.

A simplified example of the effect that these proposals could have on a $50mm business transaction is included below. In this example, the seller receives approximately $7.5 million less after-tax proceeds, representing a net cash reduction of 25.7%. This impact does not include other potential estate planning, tax planning, or wealth management considerations related to American Family Plan proposals which may or may not affect a given seller. |

|

|

Options to Consider Often capital gains taxes are discretionary. Individuals generally have greater flexibility related to timing of asset sales. Except in the case of forced liquidation, asset owners can determine – with effective planning – their capital gains tax burden in a given year.

One common strategy being explored by RKCA’s clients is accelerating a liquidation or transfer of assets of equity before changes are expected to be enacted. For many of RKCA’s clients, this includes selling their business. Business sales do not happen overnight. In fact, they often take 30 weeks to complete.

If you are a business owner who has thought through the implications and timeline to selling your business, we recommend starting with evaluating your goals, your business, and your situation; preferably, alongside trusted advisors. We have prepared a list of questions to ask yourself and your advisors if you are considering selling your business in the foreseeable future.

…for your Tax Advisor / Wealth Manager

… for yourself

…for your Investment Banker

We don’t know how the American Family Plan or any future legislation will play out. The early indications are that the impact may be significant to business owners looking to sell their business. If this sounds like you, we recommend seeking the counsel of your trusted advisors and make a decision based upon the facts presented to you, for your specific situation. Remember that businesses often take months to effectively prepare for sale, market, and ultimately sell so time is of the essence. |

|

|

Disclosure: RKCA is not a tax accounting firm, nor does it offer tax advice. We recommend that you speak with and refer all tax related questions to your independent tax advisor. Certain information contained herein was obtained from third-party sources that are believed to be reliable. Any opinions expressed herein are for informational purposes only as of the date of writing and may change at any time based on market, legislative or other conditions and may not come to pass.

This material is provided by RKCA Services, LLC. Investment banking services provided by RKCA, Inc., Member SIPC/FINRA. Non-securities related services provided by RKCA Services, LLC. 1077 Celestial Street, Cincinnati, Ohio 45202. Phone: 513.371.5533. |

|

CONFIDENTIALITY NOTICE: This e-mail transmission is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any unauthorized review, use, copying, disclosure, forwarding and/or distribution is prohibited. If you are not the intended recipient, please reply to the sender stating that the message was misdirected and erase and destroy all copies of the original message. If you are the intended recipient, but do not wish to receive communications through this medium, please so advise the sender immediately.

© Copyright 2021 RKCA. All rights reserved.

Securities offered through and investment banking services offered by RKCA, Inc., member FINRA/SIPC. 1077 Celestial Street, Cincinnati, OH 45202. Investing involves the risk of loss. Past performance is not indicative of future results. Click here for important disclosures as well as our Form CRS.

The person(s) providing the testimonial(s) herein have experience in the services that RKCA, Inc. provides. Their respective experience with RKCA, Inc. may not be representative of all other Clients of RKCA, Inc. Testimonials are not paid for by RKCA, Inc. Testimonials do not constitute a guarantee of future performance or success related to any product, transaction or service.

|

|

|

|

Proposed Capital Gains Tax Increase:Should Business Owners speed up planned sales?By Mono Bhattacharya, Neil Ursic & Eric Hornung |

|

In his speech to Congress on April 28, 2021, President Biden unveiled the American Families Plan via a bill which includes, amongst other items, proposed changes to capital gains based on income levels.

It is unclear whether or not this bill will pass in its current form or any form. Given the early indications, we are exploring the potential implications of certain aspects of the bill that are critical to business owners. As part of a larger analysis of the current economic situation and market, this piece analyzes the potential capital gains changes.

At RKCA, our job is to support business owners in realizing their life’s work. Tax law changes play a role in the magnitude of that realization.

What Are Capital Gains? The Biden administration has begun to shift its focus away from the pandemic. The administration has started to focus on non-pandemic related policies, including proposals that directly and indirectly impact business owners. One such policy is an increase in the tax rate for capital gains. This proposal has caused uncertainty and concern amongst business owners in the market.

A capital gain is the profit from the sale of a capital asset. To keep things simple, the price at which an asset is purchased is the asset’s “basis.” Selling property, stock, or any asset - like a business - above its basis would be considered a capital gain. In most cases, the seller is then taxed on the profit, the difference between the sales price and the basis.

There are two categorizations of capital gains: short-term and long-term. Short-term capital gains are derived from capital assets owned for less than one year. These short-term capital gains are currently taxed at the same rate as an individual’s personal income tax rate. Personal income tax rates currently range from 10 - 37%. Long-term capital gains are derived from capital assets owned for over one year. These have been historically taxed, depending on an individual’s personal income, at a rate from 0 - 20%. |

|

|

Proposed Changes to Capital Gains President Biden’s proposed changes to Capital Gains and tangential tax proposals include:

Under the American Family Plan, “[h]ouseholds making over $1 million … will pay the same 39.6 percent rate on all of their income.” Said another way, long-term capital gains over $1 million will be taxed at 39.6%, versus a historical rate of 20%. Moreover, expanding the net investment income (NII) to all households making over $400,000, effectively increases total top tax rates to 43.4%.

It is unlikely – historically speaking – that these proposed changes would be retroactively effective for 2021 (although there were reports in the media last week that the changes may be retroactive as of April 2021). Should this bill, or one like it, be signed into law, our outlook is that it would likely take effect in 2022 or beyond.

Impact on Proceeds from a Business Sale Ultimately, if President Biden’s tax plan is enacted, there will be a substantial increase in the capital gains tax rate for top income earners. Business owners looking to sell their business often fall into this top income earner category. However, there is a possibility that the proposed capital gains tax rate will remain the same for income earners below $1,000,000. In the end, Biden’s tax plan is still just a proposal. As new plans and policies emerge, these tax proposals could alter in the future.

A simplified example of the effect that these proposals could have on a $50mm business transaction is included below. In this example, the seller receives approximately $7.5 million less after-tax proceeds, representing a net cash reduction of 25.7%. This impact does not include other potential estate planning, tax planning, or wealth management considerations related to American Family Plan proposals which may or may not affect a given seller. |

|

|

Options to Consider Often capital gains taxes are discretionary. Individuals generally have greater flexibility related to timing of asset sales. Except in the case of forced liquidation, asset owners can determine – with effective planning – their capital gains tax burden in a given year.

One common strategy being explored by RKCA’s clients is accelerating a liquidation or transfer of assets of equity before changes are expected to be enacted. For many of RKCA’s clients, this includes selling their business. Business sales do not happen overnight. In fact, they often take 30 weeks to complete.

If you are a business owner who has thought through the implications and timeline to selling your business, we recommend starting with evaluating your goals, your business, and your situation; preferably, alongside trusted advisors. We have prepared a list of questions to ask yourself and your advisors if you are considering selling your business in the foreseeable future.

…for your Tax Advisor / Wealth Manager

… for yourself

…for your Investment Banker

We don’t know how the American Family Plan or any future legislation will play out. The early indications are that the impact may be significant to business owners looking to sell their business. If this sounds like you, we recommend seeking the counsel of your trusted advisors and make a decision based upon the facts presented to you, for your specific situation. Remember that businesses often take months to effectively prepare for sale, market, and ultimately sell so time is of the essence. |

|

|

Disclosure: RKCA is not a tax accounting firm, nor does it offer tax advice. We recommend that you speak with and refer all tax related questions to your independent tax advisor. Certain information contained herein was obtained from third-party sources that are believed to be reliable. Any opinions expressed herein are for informational purposes only as of the date of writing and may change at any time based on market, legislative or other conditions and may not come to pass.

This material is provided by RKCA Services, LLC. Investment banking services provided by RKCA, Inc., Member SIPC/FINRA. Non-securities related services provided by RKCA Services, LLC. 1077 Celestial Street, Cincinnati, Ohio 45202. Phone: 513.371.5533. |

|

CONFIDENTIALITY NOTICE: This e-mail transmission is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any unauthorized review, use, copying, disclosure, forwarding and/or distribution is prohibited. If you are not the intended recipient, please reply to the sender stating that the message was misdirected and erase and destroy all copies of the original message. If you are the intended recipient, but do not wish to receive communications through this medium, please so advise the sender immediately.

© Copyright 2021 RKCA. All rights reserved.

Securities offered through and investment banking services offered by RKCA, Inc., member FINRA/SIPC. 1077 Celestial Street, Cincinnati, OH 45202. Investing involves the risk of loss. Past performance is not indicative of future results. Click here for important disclosures as well as our Form CRS.

The person(s) providing the testimonial(s) herein have experience in the services that RKCA, Inc. provides. Their respective experience with RKCA, Inc. may not be representative of all other Clients of RKCA, Inc. Testimonials are not paid for by RKCA, Inc. Testimonials do not constitute a guarantee of future performance or success related to any product, transaction or service.

|

|