Over the past two years, investors have navigated significant volatility in short-term investments, driven in no small part by skyrocketing inflation and aggressive interest rate increases by central banks globally. As a result, cash managers such as corporate treasurers must keep careful watch over portfolio diversification, investment duration and regulatory changes. To better understand the challenges and opportunities that cash investors face amid this volatility, we partnered with the publication Treasury Management International to survey more than 200 corporate treasurers across global regions and industries.

The survey covered a range of topics, including how this market has impacted their investment strategies and how they have positioned their portfolios for uncertainty ahead.

Among the findings in the survey, it’s likely no surprise — given the recent global rate-hike campaigns among central banks — that 41% of survey respondents picked rising interest rates as their number one concern impacting their short-term investment decisions while 15% selected inflation. Treasurers are understandably concerned about higher interest rates, with a focus on whether they will increase further and when they might start to taper off. But in the meantime, we think treasurers largely are seeking to benefit from elevated rates while still maintaining liquidity and protecting principal.

We think it’s now getting to a point where central banks in the U.S., the eurozone and U.K. are closing in on the peaks of their policy rates , if not already there. And already, based on futures markets, investors are expecting rate cuts as early as March 2024. We think that’s too aggressive. While inflation is moderating, we think it is still too high relative to central banks’ targets. We don’t see central banks hurrying to cut rates any time soon.

What Cash Investors Can Do

So what should corporate treasurers and other cash investors do to make the most of this environment? Finding the answer to this question may particularly challenge less experienced treasurers who had become accustomed to low or even negative cash rates for more than a decade and are now making investment decisions in a rising rate environment for the first time in their careers. And we think more seasoned treasury professionals are discovering that the investment approaches that worked more than 10 years ago don’t necessarily suit the current environment.

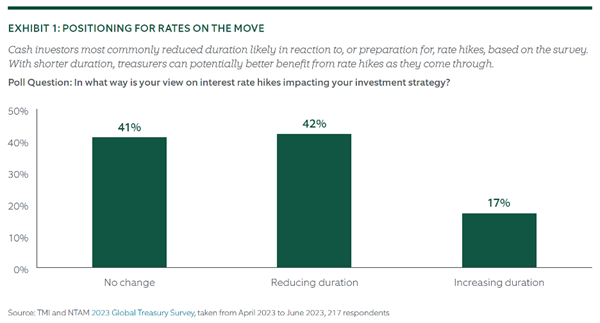

There are some levers cash managers can pull to make the most of rates on the move, including duration, as shown in Exhibit 1. Uncertainty over interest rates and inflation likely requires caution by investors about how much duration they maintain in their portfolios. With shorter duration, treasurers can potentially better benefit from rate hikes as they come through, if they believe rates are still rising. Those who believe cuts are in the pipeline sooner rather than later likely will want to extend their duration. As such, we think it’s a careful balancing act between liquidity needs and positioning for a direction view on short-term rates.

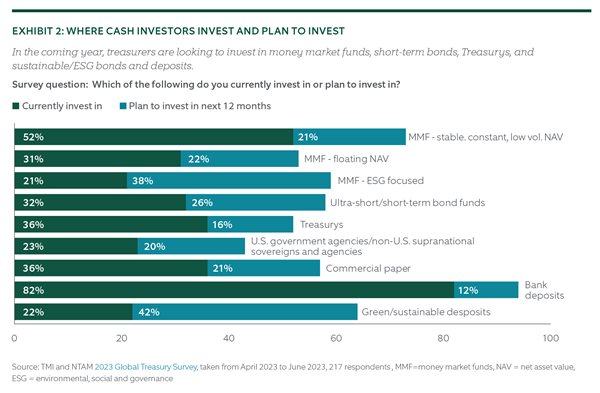

Our survey may offer insight on options available to cash investors. In early 2023, during the banking crisis, we saw significant inflows into money market funds. While the impact of the banking crisis has calmed down, many corporate investors have opted to stay in money market funds.

Indeed, 73% of respondents said they have invested in or plan to invest in money market funds with stable net asset value and 53% in those with floating net asset value (Exhibit 2). Ultra-short/short-term bond funds grew in popularity with investors’ search for yield. While 32% of treasurers surveyed were already invested in ultra-short or short-term funds, 26% more planned to invest in them.

These instruments may interest treasurers more in particular if money market rates begin to fall. Treasury teams also are paying more attention to sustainable investing. Of the respondents to the survey, 38% not already invested plan to invest in money market funds that conform to environmental, social and governance (ESG) standards and 42% intend to use green/sustainable deposits.

Managing Cash Amid Volatility With a Wider View

Even if inflation dies down in 2024, we think volatility and uncertainty around short-term interest rates likely will remain for a while, creating risk and opportunity for cash investors. As investors form views about the direction of interest rates, they can act on those views by adjusting duration of their portfolios. However, they can consider other options in their efforts to preserve capital and liquidity while potentially boosting yields, including ultra-short and short-term bonds, money market funds, and sustainable investments.

Disclosure