Stormy Economic Conditions Ahead

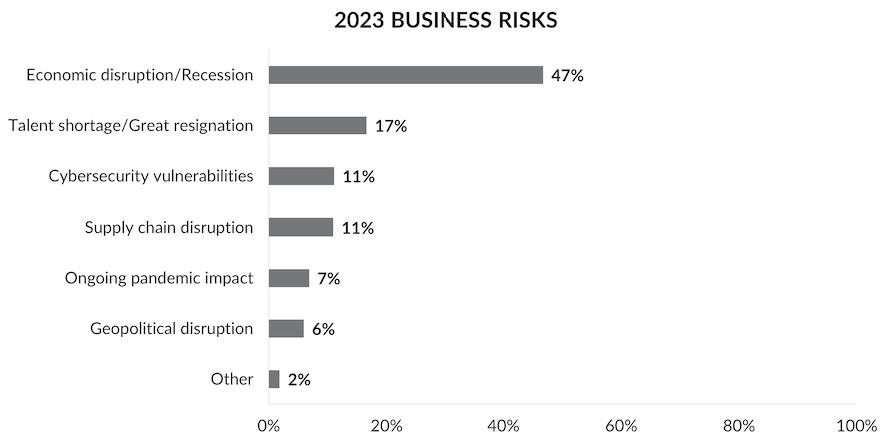

According to the survey, which we coined as the Fall 2022 Financial Decision Makers Survey, economic disruptions and recession are the top concern for nearly half of organizations as they move into 2023. This far outdistanced concerns about talent shortages, cybersecurity, supply chain challenges, and geopolitical disruption. Not surprisingly, it was also the top concern in the May iteration of the survey at 30%. However, in the Fall survey, this figure rose to 47% of respondents.

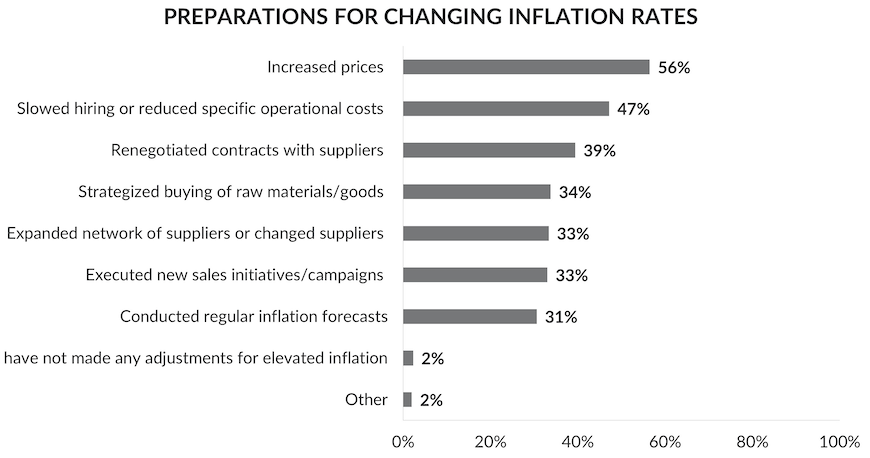

With inflation continuing to plague both individuals and enterprises, price increases are the number one way that businesses have dealt with inflation (56%), followed by slowed hiring or reducing specific operational costs (47%). Nearly half of businesses have slowed hiring or reduced specific operational costs, which is another significant increase from a year ago.

When asked how long they expect inflation to persist, three-quarters of financial leaders do not expect inflation to slow down until mid-2023 or later. This includes one-fifth of leaders who do not expect inflation to slow down until 2024 or later. The predicted timeline has shifted when compared to last fall when half (54%) believed inflation would stabilize by the end of 2022, and earlier this year, when under half (47%) expected it to slow mid-2023 or later.

To add, two-thirds of financial leaders expect a recession to occur and last until late 2023 or later, while three-quarters of financial leaders also expect pandemic-related supply chain issues to continue into 2023. So, we may be on a longer path to economic recovery than originally expected.

To prepare, most financial leaders (85%) have made at least slight alterations to their 2023 forecasts and strategies to account for an impending recession. And half are reducing corporate spending and updating tax planning and provisions to prepare for updated tax reforms (both 53%).

Battling in the War for Talent

Following the recession, the talent shortage and great resignation were identified as the number two concern for financial leaders in 2023. When asked about their hiring priorities, problem solving/decision making and strategic/business-oriented thinking are considered the most valuable skills for financial leaders. Communication skills and quantitative/analytic skills are also cited by half or more.

In addition, over half of financial leaders believe large gender pay gaps are an issue for recruiting women to financial roles. Just over half (53%) of those who hold this belief also believe it is a deterrent for financial roles within their own organizations.

DEI and ESG Initiatives Still in Focus

With ESG reporting guidelines converging and new mandatory disclosure requirements being proposed by the US SEC and regulators in other countries, investments in ESG and DEI remain a priority. Half of the organizations surveyed expect to invest more in DEI and ESG initiatives in 2023. This is a significant drop compared to expectations from earlier this year (65% in DEI and 60% in ESG). Still, over a third of enterprises expect to invest the same in DEI and ESG in 2023 (38% and 39%).

Regarding preparing for changing ESG Reporting requirements, nearly half of financial executives surveyed have started or plan to start forming an internal ESG/Sustainability team to define policies and disclosures. A similar portion will begin (or have already begun) implementing new ESG/sustainability policies. Among those who currently don’t have a plan in place, half indicate they may implement a plan if ESG reporting mandates impact their organizations.

Organizational views of financial leaders’ involvement in ESG initiatives vary. Only a quarter (23%) view ESG as core to the organizations’ mission, while less than one-third view it as a way to proactively communicate initiatives to investors and stakeholders (29%) or as a compliance requirement (28%).

Although finance and accounting departments are most commonly responsible for ESG reporting, this is still only the case for about 37% of businesses. Similarly, less than half of the financial leaders themselves are highly involved in managing the ESG process or practices.

When asked about what type of software is currently being used or planned to be used to support ESG reporting, extensions of CPM software are the most used software for supporting the collection and reporting of ESG data. Extensions of ERP systems and purpose-built ESG reporting tools are also both used by half of organizations.

Investments in Cloud Planning and Analysis Tools Increasing

The market disruption and volatility of the past few years has become a wake-up call for many organizations who have not focused on digital transformation. The economic uncertainty that’s predicted for 2023 will require Finance teams to do more with the same or fewer resources, which also points to the need for more automation and digital technologies to help streamline planning, reporting and analysis processes.

According to the survey, two-thirds of businesses use cloud-based planning and reporting regularly and 20% report using machine learning regularly within their departments. Looking forward, over half of financial leaders predict investing more in cloud-based solutions in 2023 than in 2022. Meanwhile, only one-third of companies predict investing more in machine learning.

.png.aspx)

In reference to the top use cases for artificial intelligence or machine learning, surprisingly, financial reporting is the top opportunity identified. This was followed by sales and revenue forecasting and demand planning as the second and third largest opportunity for organizations. Very few financial leaders (3%) do not see any opportunities for AI/machine learning to help their business.

With Auto AI/ML poised to reduce the barriers to adoption of AI/ML in organizations, half of all financial decision makers say their organizations plan to investigate AutoML solutions. In fact, one-quarter (28%) have already adopted AutoML solutions.

Regarding roadblocks to technology investment this year, cost and budget support was cited as the top obstacle (51%) for investing in new technologies. This is in addition to cybersecurity concerns (38%) and the technical skill gap of employees (38%).

Looking ahead

The results of our Fall 2022 Financial Decision Makers Survey show that inflation, higher interest rates, supply chain bottlenecks, and recession are here to stay in 2022 and most Finance executives expect them to continue into 2023. The mandatory ESG disclosures being proposed by the US SEC are driving many organizations to invest in their ESG processes and software to help not only with reporting compliance, but also with managing ESG and DEI initiatives.

The good news is that today’s cloud-based analytical software technologies are seeing increased adoption and are proving their worth in helping Finance teams become more efficient, plan and navigate a volatile economic landscape and increase their agility to respond. Artificial intelligence and machine learning adoption lags more mainstream planning and predictive analytics tools, but as these capabilities are embedded into modern planning, reporting and analytical software applications, Finance adoption is poised to expand rapidly.

John O’Rourke is the Vice President of Communications and Brand Marketing at OneStream Software.