©wutwhanfoto/iStock/Getty Images Plus

Not surprisingly, the pandemic has significantly impacted organizations and sectors across all businesses. However, some departments, like the tax function, are feeling the repercussions more profoundly due to tax-specific changes included in the Bipartisan-Bicameral Omnibus COVID Relief Deal and the CARES Act of 2020. This means that tax operations will be affected long after the pandemic is over.

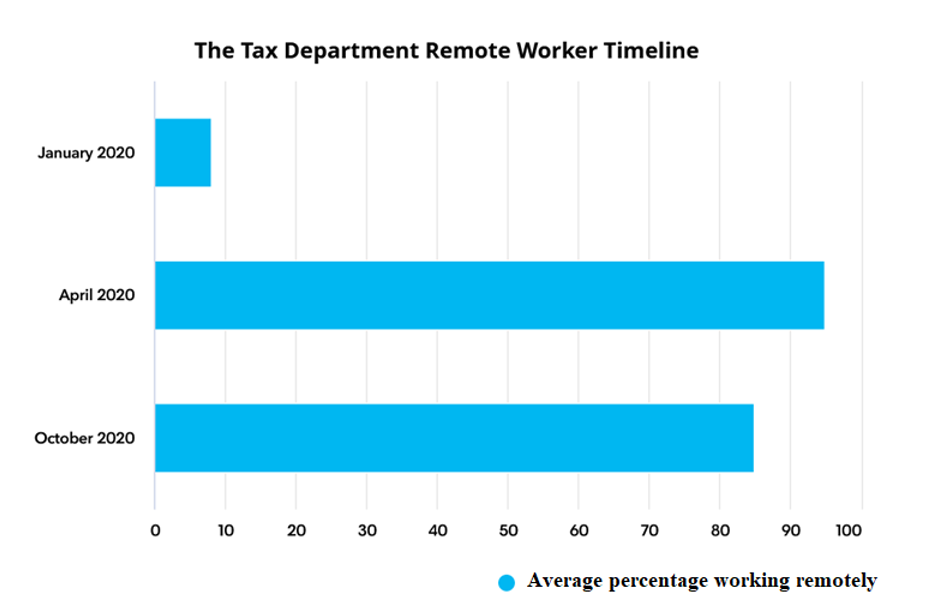

To help businesses better grasp the short-term and long-term impacts of the Covid-19 pandemic, Bloomberg Tax & Accounting conducted three surveys last year with tax professionals at public and private corporations with at least $500 million or more in annual revenue. The first survey was conducted just prior to the pandemic and had 408 respondents, the second conducted at the beginning of the pandemic had 321 respondents, and the last conducted in Q4 2020 had 473 respondents. Here is what we found.

Remote Working is Here to Stay

Widespread stay at home orders has spurred remote working, with nearly every industry having implemented either a hybrid or complete remote working operation. While the pandemic started the remote working craze, even when it is over, an overwhelming majority (91 percent) believe that remote working will become more of the norm or at least more accepted as part of the new normal work environment.

Despite its popularity, remote working comes with its share of challenges. Collaboration and coordination of activity ranked as the most problematic aspects of remote working. To address these issues, tax departments are turning to technology. The use of cloud/web-based tax software was consistently cited as a key strategy to combat collaboration/coordination challenges.

Top Three Cloud/Web-based Solutions Used to Address Collaboration Challenges

- Tax research and news software to stay up to date on COVID-19 regulations.

- Tax workflow and task management software to help manage remote work.

- Tax planning software to model changes due to COVID-19 related stimulus bills (CARES Act/Bipartisan-Bicameral Omnibus COVID Relief Deal).

With increased remote working, motivating virtual teams is naturally a new top priority. Some of the most effective ways tax departments are keeping their staff engaged include:

- Maintaining regular, honest communication with their team

- Offering flexible work hours

- Keeping team up to date on staffing, company financial health and return to work safely plans

- Continuing to recognize and highlight employees’ exceptional efforts

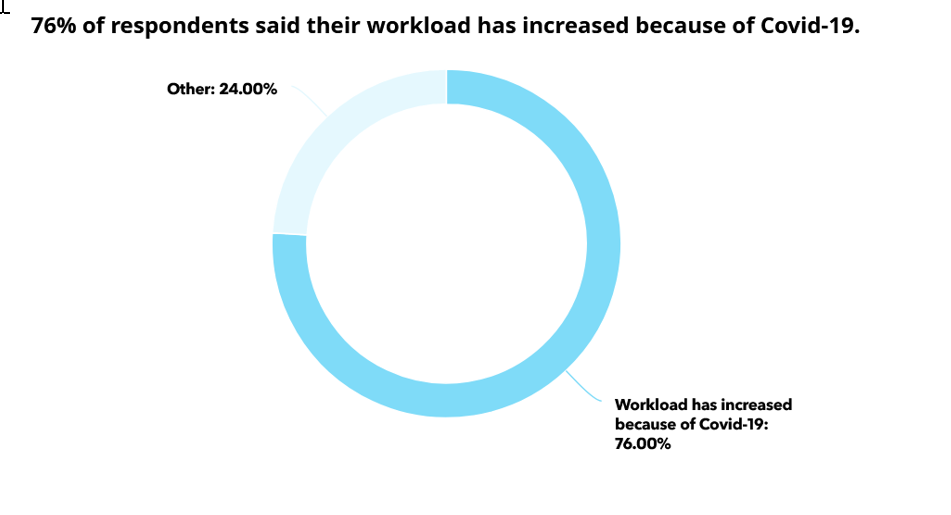

Increased Workload, Less Resources

More than three-quarters (76 percent) surveyed reported increased workloads due to Covid-19. And while over half (57 percent) indicated that staffing levels currently have stayed the same as compared to January 2020, more report staffing reductions (30 percent) than staff increases (13 percent). The good news, however, is that nearly a quarter of respondents said that they plan to increase staffing in the first quarter of 2021, indicating the hope for a quick post Covid-19 recovery.

Cash Reserves, Planning and Technology

2020 was the year of shifting business activities to align with Covid-19 realities. Like economic downturns of the past, cash management topped the list of business priorities, followed by workforce changes.

Business Activities Being Asked to Support Due to COVID-19

- Cash management (54 percent)

- Workforce changes (42 percent)

- Capital planning (24 percent)

- Operations/supply chain (19 percent)

Surprisingly, technology investments – especially in the areas of planning – remain high. A large majority (91 percent) of those supporting cash management (liquidity) said they have/are using tax planning to support cash management goals.

In addition, 77 percent surveyed indicated they will continue to invest in automation technology, and 66 percent will continue to invest in tax software/ERP integration.

Increased tech spending suggests that businesses are using automation and advanced technologies to keep pace with increased workload demands and mitigate Covid-19 impacts.

COVID-19 Recovery Hinges on Tax Law Transparency and Clarity

Whenever tax law changes are made, confusion commonly follows. Tax law changes resulting from the CARES Act of 2020 and the Bipartisan-Bicameral Omnibus COVID Relief Deal are no exception. When asked if there was one thing about tax law that they would want the new/returning administration to address post-election, roughly two-thirds (63 percent) selected the simplification/clarification of US tax laws and regulations, and roughly a third (32 percent) selected the simplification/clarification of international tax laws and regulations. Knowing tax law complexity is and will continue to be the norm, many companies are turning to tax research and news software to stay up to date on COVID-19 regulations. They are also looking to tax workflow and task management software to model various scenarios resulting from the two major COVID-19 stimulus policies in the past year alone.

Savvy organizations know that the survival strategies and tactics implemented today will determine the rate at which they recover from the Covid-19 pandemic.

Lisa Fitzpatrick is the President at Bloomberg Tax & Accounting.