©SIphotography/ISTOCK/THINKSTOCK

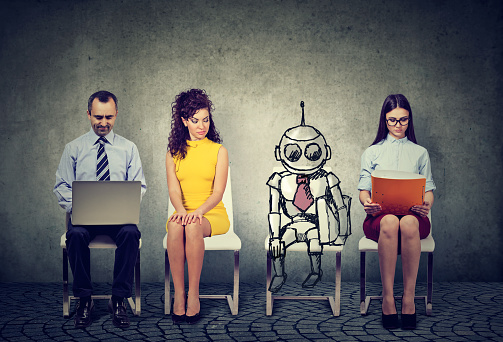

You might have gone into accounting assuming it is a stable profession. Every person and business turns to their accountant at some point for financial guidance. However, as businesses adopt new technologies like automation and machine learning at unparalleled speeds, the nature of work across all industries is subject to change. This is especially true for the finance and accounting pros as research by McKinsey revealed that 43 percent of work in this sector is susceptible to automation.

While 43 percent seems like a lot of time to gain back in the workday, finance pros are some of the most chronically overworked. A 2017 study found that almost half of accountants (45.7 percent) put in more than 13 extra days of work a year, with one in 10 working seven days a week. Automation might actually help to even out work-life balance for some accountants, but this won’t come without a massive shift to the industry.

Over the last few decades, accountants and financial analysts have seen their days taken over by repetitive tasks like data entry and spreadsheet reconciliation. These manual activities are not just arduous, but they are highly prone to human error. Paradoxically, when studying to become accountants, these professionals were never trained to simply crunch numbers, rather they were taught to analyze the data to advise clients. Accountants are bogged down by menial work. But, the real value they bring is in their ability to offer strategic recommendations, something they have little time for day-to-day.

While the finance industry has adopted new technologies in an attempt to lift this burden, paper trails still remained – only they were digitized. ERP systems like Oracle and SAP have initiated some advancements for this space, but the “paper on glass” solutions meant that accountants still have to deal with mountains of financial data. Instead of organizing them away in physical file cabinets, they are stuck transferring them between servers and desktops.

The influx of automation and robotics will transform the finance industry in a way that is long overdue. What has always been a technologically savvy profession will finally be able to benefit from these innovations in a tangible way. By integrating robots with the ERP system and giving them these rules-based tasks from end-to-end, accountants are able to generate reports more quickly and accurately. This lets them hand over their repetitive and often mindless data-driven activities to a piece of software that can do it even better, and faster, allowing the accountants to spend even more time doing the work that really matters – analyzing data and offering strategic advice, bringing more value to the business and their clients.

Perhaps this technology will empower accountants to move to the 80/20 model, where 80 percent of their time is spent analyzing and advising, with just 20 percent on the actual legwork. While they will still need to keep tabs on their robot counterparts, they will be able to spend way more time on the strategic activities that actually move the needle for the wider organization. This will also offer some relief around controls and audits, as these processes can be done without error by software robots.

As accountants wonder what the future holds as robots become a staple in their industry, they can rest easy knowing that while their roles are subject to change significantly, this change is for the best. The nature of their work will become more transformational, while staying just as steady, with new roles like business analysts and risk and control managers increasingly in demand. The timing of this shift comes as more millennials enter the workforce, and look for more meaningful and value-add jobs, making the accounting industry even more appealing to the next generation. As automation takes over, finance pros can kiss menial activities goodbye, and begin to embrace a new style of working that is more strategic and rewarding, with hopefully less overtime.

Shak Akhtar is SVP Robotics & Customer Experience Officer at Redwood Software.