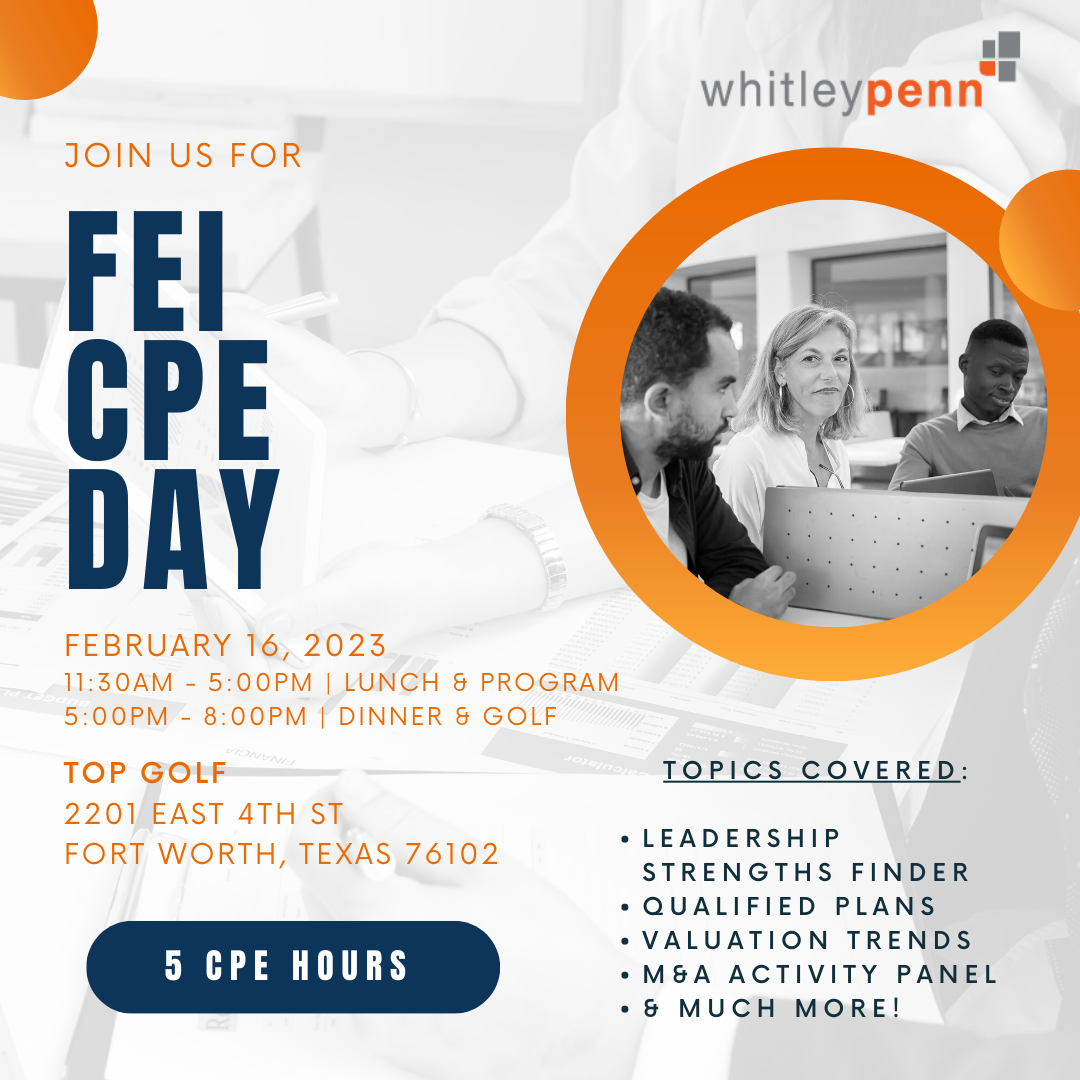

Whitley Penn – CPE Day Program Sheet

Program 1:

60 mins (Non-Technical) 12-1:00 PM

Title: A Strengths-Based Approach to Leadership

- Introduction to Strengths

- Four Domains of Leadership Strengths

- Using Your Strengths as a Leader

- Taking Strengths Back to Your Organization

Instructor: Dave Adcox is the Director of Learning & Organizational Development for Whitley Penn, based in their Fort Worth office. With more than twenty years’ experience in leadership, learning, and organizational development, Dave’s primary focus is translating talent and learning into business results. Prior to Whitley Penn, Dave held several learning and leadership development roles at Fidelity, Citigroup, and Nokia. He holds a BA in English from the University of Texas, an MEd from the University of North Texas, and an MBA from the University of Dallas. Outside of work, Dave spends his time with his wife of 25 years, two college-aged sons, and a slightly crazed rescue dog named Teddy.

Program 2:

90 mins (Technical) 1:00 – 2:30 PM

Title: Incorporating your Business into your Personal Finances

Agenda/Learning Objectives:

- Qualified plans

- Financial/Transaction Planning, including exit planning

- Defined Outcome Investing

Instructor: Bill Weston is a partner and currently serves as the head of the investments committee for the wealth management practice, WPWealth. Additionally, he helps clients with financial tax and estate planning, retirement, insurance, and employer sponsored retirement plans.

Bill is a CERTIFIED FINANCIAL PLANNER™ and holds his Series 66 as an Investment Advisor Representative along with his Group 1, Texas Department of Insurance License. He previously worked for an institutional investment manager as a planning and investment consultant. Bill’s passion for helping others through life events speaks to his knowledge and experience in the wealth management industry.

Outside of WPWealth, Bill serves on the University of Texas at Austin Economic Alumni Committee and the American Heart Association Executive Leadership Heart Ball team. Bill lives in Fort Worth with his wife and three children and enjoys keeping his hands full with their family activities.

Program 3

: 60 mins (Technical) 2:30 – 3:30 PM

Title: Current Trends and Timeless Truths in Valuation

Agenda/Learning Objectives:

- Public vs. Private Company Pricing Multiples – Bridging the Gap

- Historical Financials – How Reliable are Past Results in the COVID Era

- Standards, Levels of Value, and Purpose of Valuation Assignment – All Valuations Are NOT Created Equal

- Qualified Appraisals – What Passes Muster with the IRS

- Valuation Discounts – What Does and Doesn’t Work

- Q&A

Instructor: Robert J. Allen, CFA, ABV has in-depth financial advisory and valuation experience with a focus on business valuation, intangible asset valuation, and value enhancement consulting. He has valued closely held businesses and partnerships in a variety of industries for a variety of purposes, including tax reporting, financial reporting, regulatory compliance, litigation support, management consulting, succession planning and transactional advisory support. Robert has extensive experience with purchase price allocations (ASC 805), goodwill impairment testing (ASC 350), stock-based compensation/options (ASC 718/IRC 409a), intangible asset valuation, estate, and gift tax valuation, litigation and collaborative law matters, buy/sell agreement valuations, fairness opinions, solvency opinions, healthcare compensation studies, and transfer pricing studies. In addition, he has experience consulting with business owners on valuation and strategic planning issues, including the identification of value drivers and business risks to evaluate the impact on business value, identification of critical success factors and key performance indicators, the development of budgets and forecasts, and strategic bench marking.

Program 4: 90 mins (Technical) 3:30 – 5:00 PM

Title: Independent Sponsor vs a Private Equity Fund Panel Discussion

Description: How do Investment Bankers view selling a company to an Independent Sponsor compared to a Private Equity Fund. Is there a current bias? Are there circumstances that make selling to a one or the other more attractive

Moderator: Daniel Boarder’s experience includes assisting private equity firms and corporate buyers in evaluating potential company merger and acquisition targets. Additionally, Daniel has managed hundreds of engagements with transaction values ranging from less than $1 million to over $1 billion. Daniel also provides evaluations of post-transaction matters such as working capital analysis and related negotiations.

Panelists