By Myles Corson

Today’s CFOs face challenges on many fronts. Most are under pressure to increase transparency in their financial reporting, which is complicated by the fact that reporting complexity and volume have skyrocketed over the last decade.

Not only has the number of reporting systems finance teams need to use increased, but major new standards for revenue recognition and lease accounting have been released, followed by ongoing changes to local statutory reporting and regulatory requirements.

Core, traditional finance activities continue to absorb significant effort, with 56 percent of finance leaders saying that they cannot focus on strategic priorities because of the time spent on compliance, controls and costs in the recent EY survey the DNA of the CFO: do you define your CFO role? Or does it define you?

At the same time, CFOs are expected to play a significantly expanded business role. On the technology front, CFOs are dealing with the impact of new tools and digital business models, as well as the proliferation of data and the challenges of making commercial sense of it. Of the finance leaders surveyed, 51 percent also said they cannot focus on strategic priorities because of increasing operational responsibilities.

In the midst of this, CFOs must lead the next phase of finance transformation. This wave of technology-driven change will transform how finance departments add value: by acting as the trusted source of real-time data and insights and enabling effective business decision-making.

But having real-time data and analytics is just the beginning. Forward-looking finance leaders can meet these challenges by:

- Defining a vision for their finance organization

- Rethinking information technology (IT) to harness emerging technologies (and making pragmatic decisions about the optimum time to invest)

- Investing in the right people, which begins by determining the new people skills and capabilities their finance organization will require

Defining a Vision

A clear vision for the future finance function — one that’s aligned with the organization’s overall purpose and business strategy — gives finance staff members worldwide a common ambition and provides focus for efforts and investment decisions. In the digital age, a CFO’s vision for the future of finance should include how smart technology and smart people should work together to create value. In addition, it should define how specific technologies will enable people using their skill sets to thrive, not replace the personal aspect of the finance function.

When defining the finance organization’s vision, it’s important to collaborate with the corporate controller and other finance executives, as well as to listen carefully to the needs of other internal “customers.” By collaborating and engaging broadly, CFOs can benefit from diverse ideas, understand the needs of all stakeholders, and secure their buy-in and commitment to realizing the vision.

Rethinking Technology

Leveraging their extensive experience with enterprise resource planning (ERP) solutions, many finance leaders understand how technology can improve the performance and value of their finance department. They can also identify departmental weaknesses that limit their organization’s ability to take advantage of technologies such as advanced data analytics, which can have enormous potential to transform financial reporting.

According to EY’s survey The DNA of the CFO, key barriers to more effective use of technology include:

- Lack of integration between IT systems

- Difficulties accessing data

- Poor quality data

- Slow adaptation to change by employees

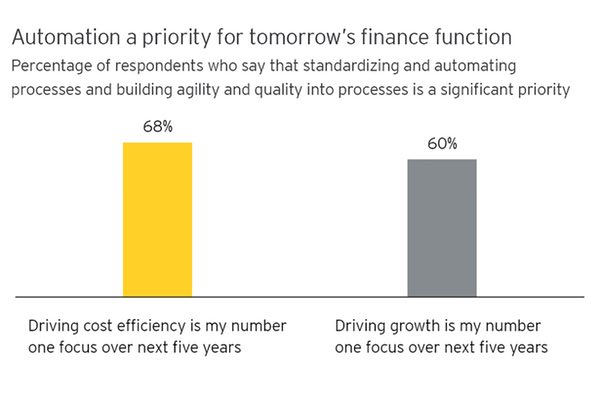

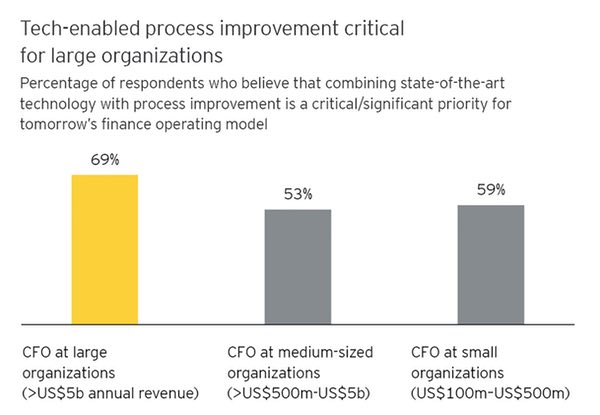

Given the proliferation of new technologies available to transform finance operations, it is vital for CFOs to address these barriers. Advances such as in-memory computing, the cloud, high-performance analytics, mobility, artificial intelligence (AI), blockchain and robotic process automation (RPA) offer CFOs exciting opportunities to reimagine their finance function (see sidebar). Forward-looking CFOs already are driving adoption of these technologies and leading the transformation that ensues from such innovation (see Charts 1 and 2 below). For example:

- 65 percent of respondents say standardizing and automating processes and building agility and quality into processes will be a significant priority for tomorrow’s finance function.

- 58 percent say combining leading-class technology with process improvement will be a major focus for the future finance function.

- 55 percent say “improving digital technology skills in areas such as mobility, the cloud and SaaS” is a significant priority for the finance function.

In addition to saving costs, managing risk more effectively and increasing insight, technology solutions are expected to yield other significant benefits. But to make the most of these new technologies, finance leaders should challenge assumptions, consider taking calculated risks and encourage experimentation. At the same time, they must also manage the risks inherent in each technological innovation.

The First Priority: Advanced Data and Analytics

To set the right course for the future, finance functions should get better at processing — and extracting forward-looking insights from — large amounts of data, keeping track of new types of data and incorporating them into their models as they emerge. Equally important, data and analytics need to be in real time. In a recent EY report, The DNA of the CFO: is the future of finance new technology or new people?, Vincent Dell’Anno, Executive Director of Performance Improvement at Ernst & Young LLP, mentioned that sensors allow companies to act in real time or near real time today. To take advantage of this, companies will want to facilitate analytics as close to the source of the data as possible, drive streaming analytics and keep data relevant to real business problems.

Sophisticated, forward-looking analytics can also enhance a finance organization’s performance in a range of areas, by, for example:

- Deploying big data platforms that are designed to be interrogated by computers rather than humans and using machine learning to analyze massive data sets to make fine-grained predictions, such as how an asset on a balance sheet will behave

- Combining structured and unstructured data (such as social media and web monitoring) to identify rogue activities, patterns and trends, and mitigate risks such as fraud or cyber breaches

- The payoff for innovative uses of real-time data and analytics can be huge. Armed with these tools and insights, finance departments may:

- Eliminate time lags and close data gaps in critical business information requests

- Improve their ability to predict outcomes — and manage strategic risk — through scenario analysis and forecasting

- Better understand the financial impact of key strategic and operational decisions

- Provide faster, more accurate information to key stakeholders — from investors to boards

- Improve enterprise performance measurement by combining financial and nonfinancial data

- Increase confidence in the quality and accuracy of reporting provided to decision-makers across the enterprise.

At the same time, by implementing real-time data and analytics, finance organizations can simultaneously address the top three barriers, according to the EY study The DNA of the CFO: is the future of finance new technology or new people?, to more effective use of technology: lack of integration between IT systems, difficulties accessing data and poor quality data.

Investing in People and Skills

Technological breakthroughs are disrupting business strategy and the ways finance teams work and collaborate. As CFOs build tomorrow’s finance function and seek to better manage the finance function of today, they will need to find people with the skills and motivation to complement technological innovations, as well as to embrace rapid change, different roles and new approaches.

Effective change management, including transparency about the rationale and continuous communication, will be critical for finance transformations to be a success. Surveyed CFOs cited “staff capacity to adapt to change” as the main barrier to adopting new technologies. In addition, they indicated 47 percent of their current finance function does not have the right mix of capabilities to meet future demands.

As the technological tools of tomorrow begin to play a role in daily operations, the need for — and the importance of — finance people will not abate; however, the skills people must have will evolve.

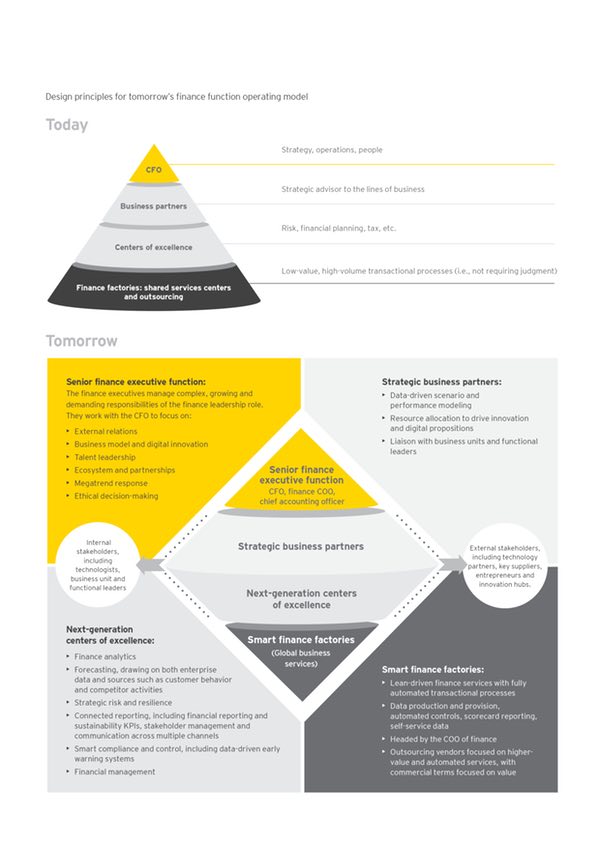

For example, as summarized in Chart 3 (next page), as the finance function evolves to become a data-driven decision center, finance professionals will be even less focused on generating reports and information, and far more focused on using the available data to drive decision-making.

As a result, CFOs will need to build and extend capabilities of their team to include:

- IT skills, including data and analytics, which have emerged as the most in-demand expertise in today’s connected economy

- Relationship development skills to engage with important stakeholders

- The ability to understand the information needs of different stakeholders and communicate clear insights grounded in robust analysis.

At the same time, finance functions should take advantage of their existing skill sets and grow them through tailored employee training, focusing on individuals with the aptitude, interest and ability to synthesize reporting information. Finance executives should map their current people and organizational approach for reporting according to benchmarks for future finance operating models because this will help them identify gaps to fill.

Tomorrow’s Operating Model in Action

Imagine the leader of a business unit needs to understand why demand for a once market-leading product is falling steadily. In the future finance function, the business unit leader would speak to their finance business partner, who would ask the data factory to pull together internal data about the product line, and combine it with external data about wider market movements in the product segment and competitor moves.

Using AI tools, a data scientist in the financial analytics center of excellence would analyze this massive data set to identify trends and use visualization tools to model different scenarios. The business unit’s finance partner would review the scenarios with the unit’s leadership and marketing team, and help begin the work to develop possible solutions.

Supporting Business Partnering

If organizations are to succeed in turning increasing amounts of data into better strategic decision-making, finance functions should make business partnering even more of a priority. CFOs must have a team of highly credible finance executives capable of acting as finance’s interface with its internal clients. This team’s role will include helping align the work of the analytics teams with business priorities, and helping leaders understand the implications of their data.

EY’s research shows 67 percent of CFOs worldwide believe that “improving business partnering between finance and the business” is a major priority of the finance function.

Finding people with these abilities is not easy, in part because there is lack of clarity around the partnering role. To build up this capability, CFOs need to shift what is expected of the finance business partners from challenging budgets to challenging business models. And they need to reward those who combine subject-matter expertise with the right abilities and skills to challenge the business units’ strategies.

Key Takeaways

In the finance function of the future, leading CFOs will strike the right balance between technology and people, and work continually to focus each on the tasks that best suit their skill sets. By defining a clear vision, focusing on expanding technological capabilities and developing talent within their organizations, CFOs can mature their financial processes and protocols to deliver real-time, trusted reporting and even the predictive insights needed to navigate unpredictable business environments.

This can allow CFOs to focus on innovation, respond to the rapidly changing business context and drive the business forward.

Myles Corson is the Markets Leader, Americas Financial Accounting Advisory Services, for Ernst & Young LLP.